LOS ANGELES, (AFP)— The estate of Michael Jackson is closing in on a deal to sell half its interests in the megastar’s music catalogue, in a deal worth up to $900 million, Variety reported.

The sale, to Sony and a possible financial partner, could include a slice of the singer’s publishing and recorded-music revenues, as well as Broadway show “MJ: The Musical” and as-yet-unmade biopic “Michael,” the trade title said.

If it goes ahead, the deal would be the biggest yet in the burgeoning music catalogue market, which has already seen some eye-popping transactions.

They have included the sale of Bruce Springsteen’s publishing and recorded music back catalogue for $600 million — also to Sony — and $400 million that Universal Music paid to buy Bob Dylan’s recorded music.

Last month, pop juggernaut Justin Bieber sold his music publishing and recording catalogue shares to the Blackstone-backed Hipgnosis Songs Capital for $200 million.

Variety, which cited three unnamed sources for its report, said the identity of Sony’s partner in the blockbuster deal — or even the existence of one — was not clear.

Previous deals in the sector have involved investment outfits like Eldridge Industries, owned by Todd Boehly, who is chairman of Premier League football club Chelsea, and who also has a stake in the Los Angeles Dodgers baseball team.

Michael Jackson, who died in 2009 after decades of performing and recording, has one of the most financially lucrative back catalogues of any artist.

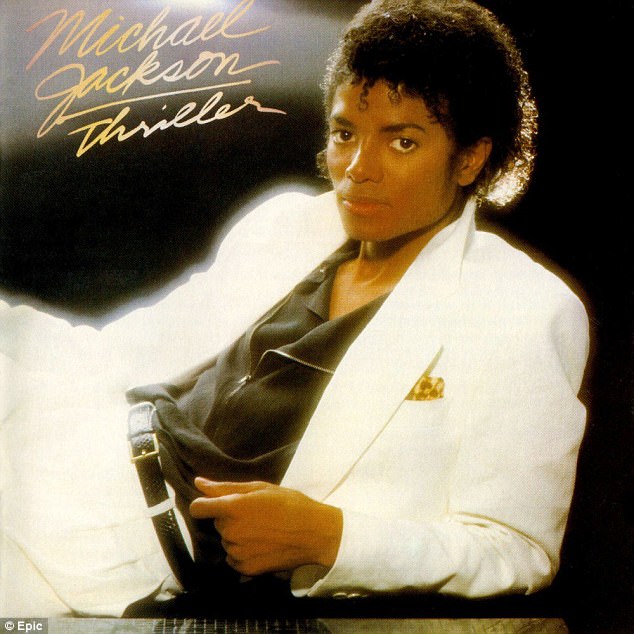

His 1982 album “Thriller” is one of the biggest sellers of all time.

Investors are increasingly attracted to music catalogues as an asset class that they believe has long-term value in the age of streaming.

Owners of a song’s publishing rights receive a cut in various scenarios, including radio play and streaming, album sales, and use in advertising and movies. Recording rights govern reproduction and distribution.

You must log in to post a comment.